The newsletter was in hibernation for a while, as the author lacked the strength of character to keep up a regular publishing schedule. A tendency to let information percolate, ferment and crystallise makes for ever fewer and denser articles. Soon all you’ll get is one terse biennial seaweed haiku.

Several newsletters are on the way, though. The first one, below, is on seaweed biorefining.

The coming boom in alginates and fucoidans

Brine-kissed hands tend rows,

New use beckons, yet the price!

A tangled seaweed web.

Who wants to build a seaweed biorefinery? Aber Actives, Alginor, Biomara, Carbonwave, Everything Seaweed, Goa Ventures, Inclita Seaweed Solutions, Kelp Blue Biotech, Macrocarbon, Macro Oceans, Marine Biologics, Oceanium, Olmix/Amadeite, Origin by Ocean, Sea6 Energy, Seachange Biochemistry and Thalasso Ocean.

What is remarkable is that all of the above companies

focus on cold-temperate species and pelagic Sargassum

are based in the Americas and Europe

The main outlier is Sea6 Energy, processing warm water species in India and Indonesia. That said: no Chinese companies. Korea, Japan? Nope.

So why are all these biorefining companies coming from places without large seaweed harvests, while the Asian giants are napping through the first half of the show? Is China behind, or are they “hiding capabilities and biding time”? Any digging on Chinese capacities tends to come up with spades of contradictions.

Business models and supply chains

Up until now, the harsh chemicals often used in seaweed processing have not allowed the full value of the biomass to be extracted. The key disruptive innovation that all seaweed biorefineries share is a zero-waste approach, enabled by newer, more careful extraction techniques that leave more of the valuable elements intact.

Beyond this, there is a great variety of approaches in terms of sourcing, scale, process, products and business model.

Sourcing supply

5 approaches exist. Let’s rank them from least to most disruptive (some companies mix several strategies):

Wild harvested standing stocks: Alginor, Aber Actives, Everything Seaweed

Wild harvested seaweed blooms: Origin by Ocean, Olmix/Amadeite, Thalasso Ocean

Cultivated seaweeds from Europe and US: Oceanium, Macro Oceans, Biomara, Inclita SS

Vertically integrated, very large scale (> 1000 km², > 1 million tonnes): Kelp Blue, Sea6 Energy, Macrocarbon

Some companies are very specific about the species of algae they can or want to refine. Others are species agnostic.

Scale

In terms of scale, two approaches exist: the large-scale factory (hub-and-spoke model) vs the (containerised) microbiorefinery, with a modular best-of-both-worlds approach in between.

Proponents of the hub-and-spoke model say you can never achieve the necessary economies of scale with micro-biorefineries, not even with a hundred of them, the model only works for the high-end components. Microbiorefinery believers say staying close to the source improves the quality and can be cost-effective.

A modular approach does a first processing step close to the source, while refining happens at a more distant central location, similar to, for instance, the dairy industry.

Process

Depending on your choices in the previous paragraph, you will prefer to work with fresh seaweeds or preserved seaweeds. They each come with their own pluses and minuses.

One important thing to consider is that the volumes of valuable micro-compounds fluctuate throughout the year. It all depends a lot on the weather, the season, the moment of harvest. So processors need to think hard about how to get consistency and start derisking.

Approaches to extract and refine vary considerably. Some options include enzymatic extraction, cell-burst technology, ultrasound, microwaves, homogenisation, solvents, supercritical CO2 extraction, ... To note: it has been said that supercritical CO2 extraction is progressing quickly because of its use in extracting precious substances from another, vastly more popular weed: cannabis sativa.

Business model

Should the initial focus be on the high-value, low-volume molecules (fucoidans, beta-glucans, mycosporine amino acids, …), or on the low-value, high-volume elements (alginates, biostimulants, …)? Companies with cheaper, wild-harvested biomass tend to opt for the latter, while those focusing on cultivated seaweeds tend to go for the former.

One outlier once again is Sea6 Energy, who do not believe in the concept of a cascading biorefinery and use 100% of the biomass for each separate product they create. Their argument is that the volumes in terms of market demand for the different end products do not line up. Certainly, the chemical industry has had to deal with this issue in the past, having to create entire new markets for excess sidestreams (in case you ever wondered why we have so much PVC).

One additional problem for biorefineries is that with 5 product streams, you are suddenly in a bunch of businesses all at once: cosmetics, plastics, food, agriculture, hydrocolloids, … That requires a diverse sales team.

Now, about alginates

The business of hydrocolloids is principally a globe-spanning hokey pokey, where you put one ingredient in and take another one out, depending on the direction of the economy and who is currently at war with whom.

For example, as metropolitan Russia got richer at the start of the millennium, meat processors stopped using transglutaminase and replaced it with more functional (but pricier) high-G alginates. Kimica (Japan), Algaia/JRS (France/Germany), and IFF/DuPont (US) are the 3 largest high-G alginate producers globally. Due to the war, Russian meat is now injected with cheaper, more available Chinese grades instead, and demand and price for high-G has dropped.

Despite this drop, tension on the market continues for certain types of alginates. Finn Aachmann, head of the Norwegian Seaweed Biorefinery Platform, says:

"Alginate is becoming a scarce commodity on the global market. There are great opportunities here if we could cultivate more kelp that yielded alginate of good enough quality.”

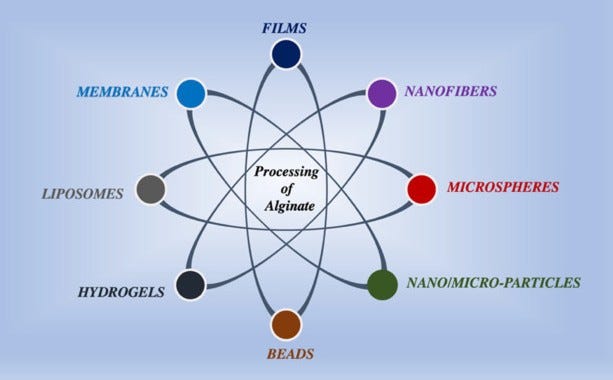

As one of the major components of brown seaweeds, alginates are a recurring theme across the board for seaweed biorefining startups. If we imagine that at least some of these startups will succeed, it is reasonable to expect a considerable expansion of the world’s alginate supply in the next 5 years. Greater supply should drive down prices and allow a broader set of alginate-based consumer products, currently still under development, to come to market (plastics, laundry detergent sheets, diapers, tampons, electronic textiles, aerogels, hydrogels, …).

Meanwhile, back in the lab, our understanding of alginate chemistry continues to evolve, and new use cases proliferate. The long-shot, very high-value medicinal uses of alginate should be of particular interest to the patient investor. Alginate oligosaccharides have anti-tumor, anti-inflammatory, neuroprotective and antibacterial properties, as well as the ability to suppress obesity and regulate plant growth. Perhaps even more significant is alginate’s potential in drug delivery.

And what about fucoidans?

For now a relatively unknown ingredient outside of Asia, startups’ focus on fucoidans is likely to increase supply dramatically. Applications range from gut health to skin care to therapeutics, and fucoidans from certain species of brown seaweeds already have novel foods and GRAS (Generally Recognised As Safe) approval, which will certainly help market adoption.

Similar to alginates, though, fucoidans come in all different shapes and sizes, which means it is challenging to point to a clinical trial with “a fucoidan” and claim that your particular substance does the same thing. Origin by Ocean’s Mari Granström says:

“It all depends on the application; it's about synergy with the other ingredients. We should have so many different fucoidans, it's great to have that choice. But there is no "best" fucoidan. There is only application expertise.”

The core question remains of course: if the supply is really going to 10x in the near future … who is going to buy all that fucoidan? The market will need to be convinced. Expect a wave of clinical studies alongside the fucoidan tide.

Appreciate the distinction of buyers looking for high G-block alginate - if only such distinction was possible with fucoidan which has a structure that is certainly more.... complicated. High throughput chemical analysis and metabolomic approaches will certainly enhance this bio-prospecting. The high value markets are really key for NA growers, with the bulk of material going to general lower value uses in agriculture but off-take is still a major challenge

Thrilled that these posts are back! Thank you!!